Gold vs investing

23-Aug-2017

Precious metals have a store of value for ages

Author: WWW.WEALTHPLANNING.CO.ZA

There is no doubt that we are living in interesting times; and by interesting, we mean unpredictable and uncertain. In such times one tends to query what other investment alternatives are at their disposal. Hence the question of whether it’s more beneficial to invest in cold hard gold, Kruger rands in particular, or participate in the investment markets and stocks.

The main difference between the two classes of investments is that stocks are classified as “equities,” meaning that the share holder owns a portion of the company that issued the stock, while precious metals are classified as “commodities,” meaning that the owner of the metal holds a distinct, physical product.

Share holders make money when the stocks they own increase profits or improve their business standing, resulting in an increased demand to own the company, and thus a rise in the price of their stock. The concept of buying gold works more on a valuation based on the dollar price of gold and by virtue of such valuation, the rand/dollar fluctuation would also have an effect on your Kruger rand value.

Investing in gold and precious metals

Precious metals like gold and silver coins have been used as a store of value for hundreds of years. Gold is only useful at protecting purchasing power when the monetary system is in danger. The value of gold or silver does not depend on any single currency, government or company, so buying gold or silver is a another way of "hedging" against losses on other investments and the effects of inflation. A few things to consider when investing in gold are detailed below.

Storage of physical gold

Investing in physical gold requires you to find a safe place to store your coins or bars. Keeping gold in your home can be risky, due the possibility of events like floods, fires or theft.

Are precious metals affected by inflation?

So what does inflation essentially mean. It means that the value of the rand is depreciating. What the rand bought yesterday, can't be bought with the rand today.

Generally speaking precious metals are not affected by inflation because the change in currency won’t change the value of the precious metal. If it costs you R100 for a gold necklace today and R200 for the necklace in a year's time, the amount of gold you have will still be the same.

When investing, depending on your goals, an investment can be structured to match your unique requirements such as time horizons, risk appetite and investment goals. For example inflation plus 1 for short term goals, to inflation plus 7 for long term goals, also taking into consideration your risk appetite and willingness (known as your risk profile). With gold there is no correlation to a specific term or risk profile.

What tax implications are there when investing in gold and precious metals

Buying gold in the form of Kruger rands and ETF’s will attract capital gains tax (CGT), while jewelry and other personal use assets are not liable for CGT.

According to an article written by Iol, the distinction between capital gains and revenue profits is based on case law developed from court judgments. The taxpayer’s intention in acquiring the asset is a key factor. The main test is whether the asset was purchased as a long-term investment or whether it was acquired to sell on at a profit. The latter would be regarded as a profit-making scheme, with profits taxable as revenue.

Different investment vehicles can be structured to be more tax efficient and in vehicles such as Retirement Annuities and Preservers, there is no taxation on growth and even have the advantage of reducing your tax liability annually.

Is there a guarantee buy back on golds and precious metals?

There is no guarantee of gold coins buy back by any institution in the world. It all depends on willing buyer willing seller concept.

In investing, although Asset managers do not guarantee that they will buy back your shares, their large pool of shares allows your investments to be incredibly liquid, helping you avoid being stuck in the market having to find a buyer for your asset.What are the historical returns on gold and precious metals?

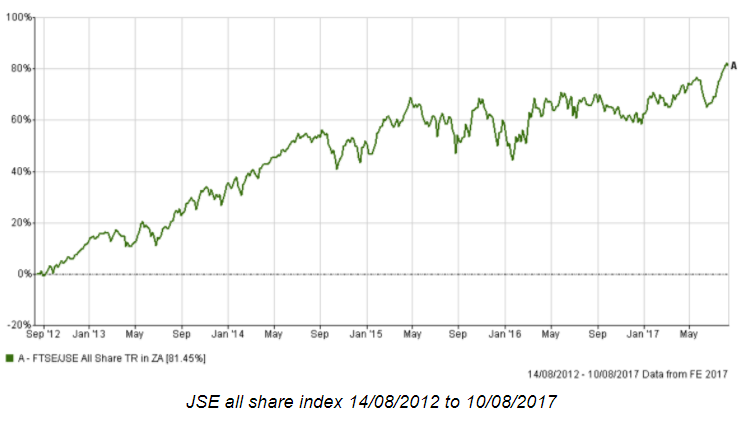

The JSE over the last 5 years has returned 81.45% cumulative (12.38% annualised). Gold has returned 32.34% cumulative (5.51% annualised) over the same period.

* investing in any asset class should not be based on historical performance alone

What fees are involved when investing in gold and precious metals?

Not paying attention to the spot price of gold is an easy way to get ripped off. Remember, dealers are there to sell you gold. They are selling metals with a high value, and they only make money on the spread or commission they charge you.

When investing, fees are structured according to the vehicle you are invested in and are regulated by legislative acts. Fees can also be tiered to decrease the more or longer you invest.

Honourable mention: gold cannot provide a regular income, nor can it use the power of compounded interest.

Rate this article:

Back to list of informative financial articles